Why your digital audio campaign should include more than just subscription services like Spotify

Digital audio advertising is one of the fastest growing segments of the digital advertising market in Canada. Estimates of the size of the Canadian digital audio market vary widely, but all agree that the opportunity is vast, with eMarketer benchmarking the 2020 digital audio advertising market at $96 million.1 At only a fraction of the nearly $1 billion dollar Canadian radio advertising market, it is clear that investment in this space is set to grow quickly as advertisers react to expanding digital audio audiences . At Rogers Sports & Media, we’ve seen digital consumption of our radio stations more than double through 2020 and 2021, both in monthly active users and hours tuned. Over the same period, downloads of our news, entertainment and sports podcasts have grown by more than 5x.

Spotify dominates the digital audio subscription market in Canada, with competitive paid services from Youtube, Apple, and Amazon all trailing behind.2 However, premium subscribers to these platforms are not reachable by marketers. Paid streaming services have certainly changed the way we think about owning music (most people don’t buy CDs or download songs for $0.99 anymore), but advertisers should be careful not to conflate the growth of premium subscriber bases with the addressable bases from ad-supported versions of audio platforms. The growth trajectory and audience profiles of these two segments differ.

For many advertisers ad-supported streaming services have earned a place on digital audio media plans, but an effective digital audio media plan should not stop at a single vendor. Including Canadian digital audio streaming and podcasts as part of your advertising plan will grow your reach, diversify your audiences, and produce better outcomes for your business. Here is why advertisers should be looking beyond pure-play streaming services for their digital audio advertising campaigns:

Premium audiences are not reachable

As mentioned previously, premium streaming audiences are not all reachable by advertisers, meaning that premium subscribers with disposable income who are more engaged cannot be reached. Subscribers to ad-free premium services represent an increasingly larger proportion of audiences. The 2021 Radio on the Move study from Signal Hill Insights shows these premium subscribers have grown from 50% of daily listeners to Spotify in 2017 to nearly two-thirds (66%) of daily listeners in 2021.

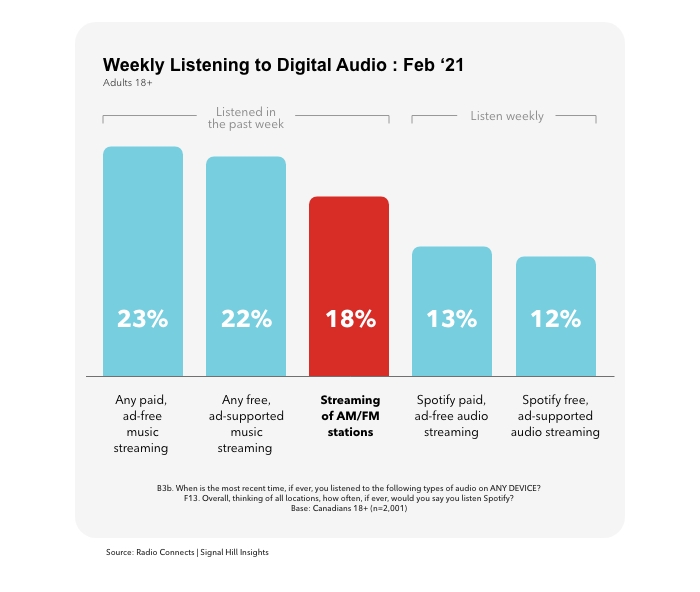

When marketers are considering the benefits of working with any partner, understanding the reach that partner delivers is paramount. Because of the ubiquity of premium subscription services in Canada, it is easy for marketers to over-estimate the size of the addressable audience on these platforms. Data from Signal Hill Insights in the chart below suggests that while Spotify overall reaches a reasonably large Canadian audience every week, the weekly reach of the ad-supported version, which is what marketers should care about, is not as big as that of digital radio. Does this mean that advertisers and marketers should buy digital AM/FM radio instead of Spotify? Not necessarily, but marketers should look beyond Spotify to achieve critical and balanced reach in their digital audio campaigns.

Digital Radio Streaming Audiences are complementary to ad-supported streaming audiences

Canadians are increasingly listening to AM/FM radio content through connected devices and these audiences are highly complementary to the ad-supported streaming listener. While digital radio listeners are younger than traditional AM/FM radio listeners, they still tend to be established adults with careers, houses, and families3, they are engaged with local news and events and are active participants in their community, and they use digital radio streaming to plan out the day ahead. On the other hand, ad-supported streaming audiences tend to be younger, are more likely to be full-time students and more likely to be in part-time employment.4 This profile makes sense, as these users have made the decision to not purchase premium streaming subscription services. For some advertisers, the younger ad-supported streaming audience will be attractive, and most advertisers will find greater success by broadening their reach to include a wider demographic profile than ad-supported streaming services can deliver on their own. Adding digital AM/FM streaming to an audio campaign can add additional reach and engagement with desirable Canadian audiences at scale.

Digital Radio Streaming is CRTC regulated

As brand safety and trustworthiness continue to be a chief concern for markets, digital radio streaming provides a level of security unequaled in the digital advertising ecosystem. With CRTC regulated content distributed digitally, advertisers can rest assured that no matter where their ads run, they will be in rigorously regulated and professional quality content. Additionally, many digital radio publishers have moved into the podcast space, and while not regulated like the digital radio streaming environment, these Canadian publishers still identify as publishers, not platforms. At Rogers Sports & Media, this means we take responsibility for the content we produce and distribute to Canadians.

Digital Radio Streaming Audiences are highly addressable

While Rogers Sports & Media’s digital AM/FM streaming and podcasting audiences possess many of the advertiser benefits typically associated with radio, including high engagement and desirable audiences, the digital nature of consumption allows for audiences to be highly targeted and segmented in new and exciting ways. Behavioural, geographic, demographic, genre, and contextual targeting are just some of the ways enhanced digital capabilities have permeated the radio streaming and podcast market. This segmentation and targetability is not the sole domain of ad-supported streaming services. Strategies and tactics used on ad-supported services will often be replicable in the digital radio streaming and podcasting space by publishers with the technology and first-party data required to execute across their digital audio portfolio.

In summary, the digital audio market is an exciting and growing opportunity for marketers to engage with Canadians in an intimate and highly personal environment. Premium subscription audio services have largely replaced the concept of owned music for many Canadians, but these audiences are not reachable by marketers. Digital AM/FM streaming and Canadian podcasts provide an opportunity for marketers to extend their reach beyond ad-supported streaming services to a growing Canadian audience who are established, highly engaged, and decidedly valuable to advertisers.

Back to top